Drive digital transformation with chatbots for banking & finance

Drive digital transformation with chatbots for banking & finance

Drive digital transformation with chatbots for banking & finance

Deploy intuitive financial chatbots to provide personalized assistance, beyond banking hours. All with the power of conversational AI.

Deploy intuitive financial chatbots to provide personalized assistance, beyond banking hours. All with the power of conversational AI.

Deploy intuitive financial chatbots to provide personalized assistance, beyond banking hours. All with the power of conversational AI.

60%

60%

60%

reduced support costs

reduced support costs

reduced support costs

25%

25%

25%

increase in leads

increase in leads

increase in leads

24/7 internal and external support

A banking chatbot with an FAQ knowledge base assists employees, contractors, suppliers, and customers all day, ensuring a robust experience for all.

24/7 internal and external support

A banking chatbot with an FAQ knowledge base assists employees, contractors, suppliers, and customers all day, ensuring a robust experience for all.

24/7 internal and external support

A banking chatbot with an FAQ knowledge base assists employees, contractors, suppliers, and customers all day, ensuring a robust experience for all.

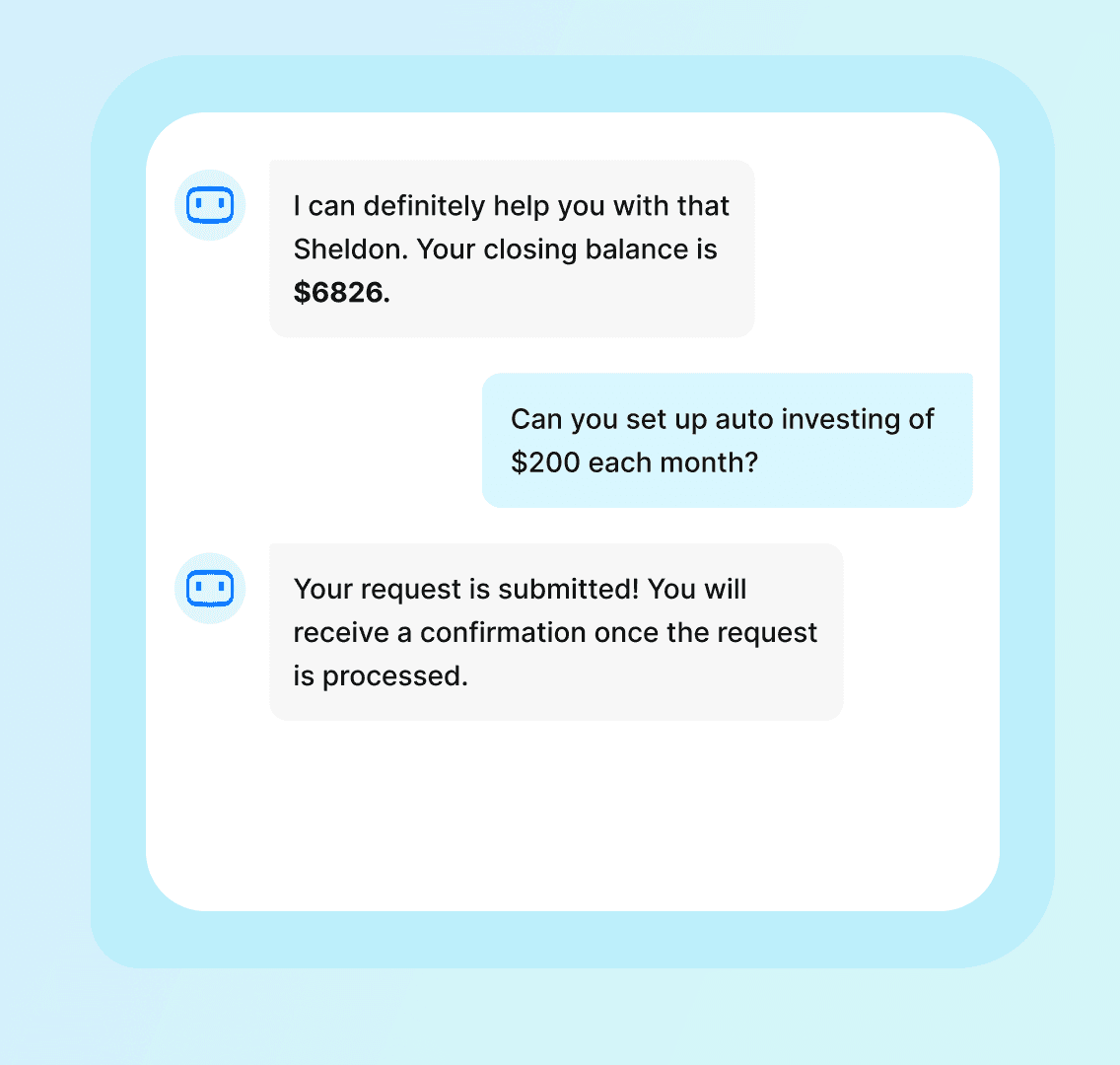

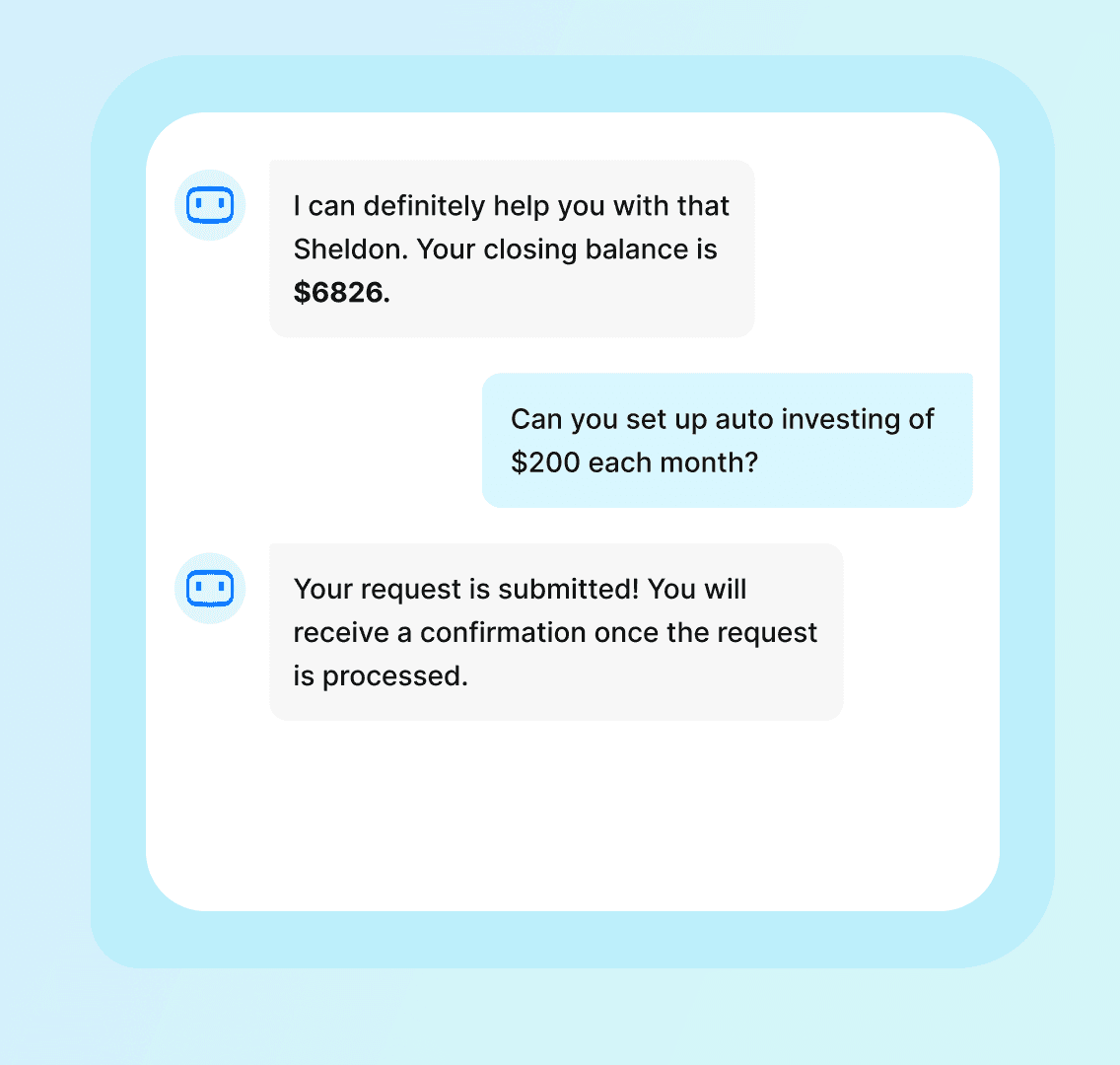

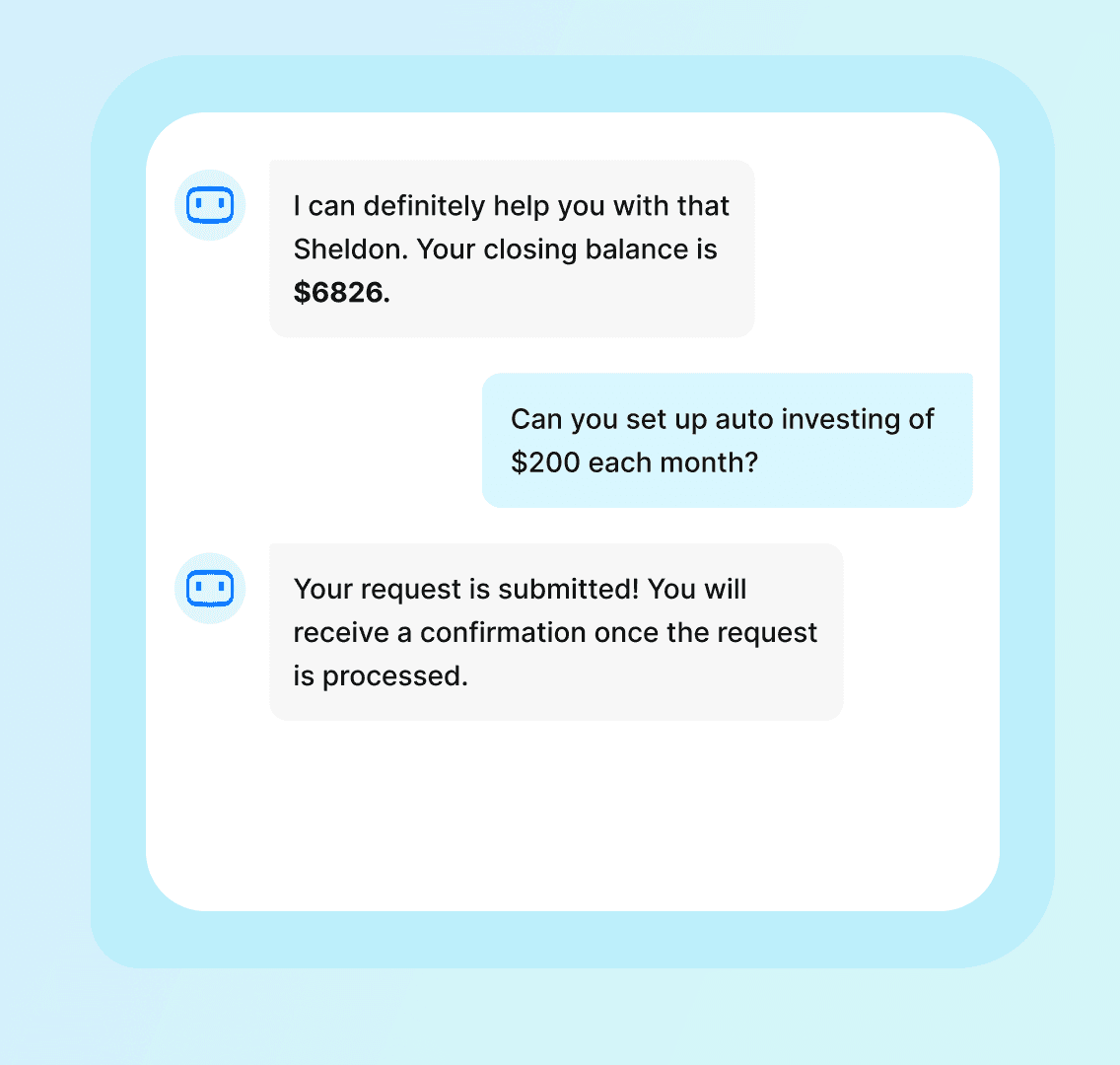

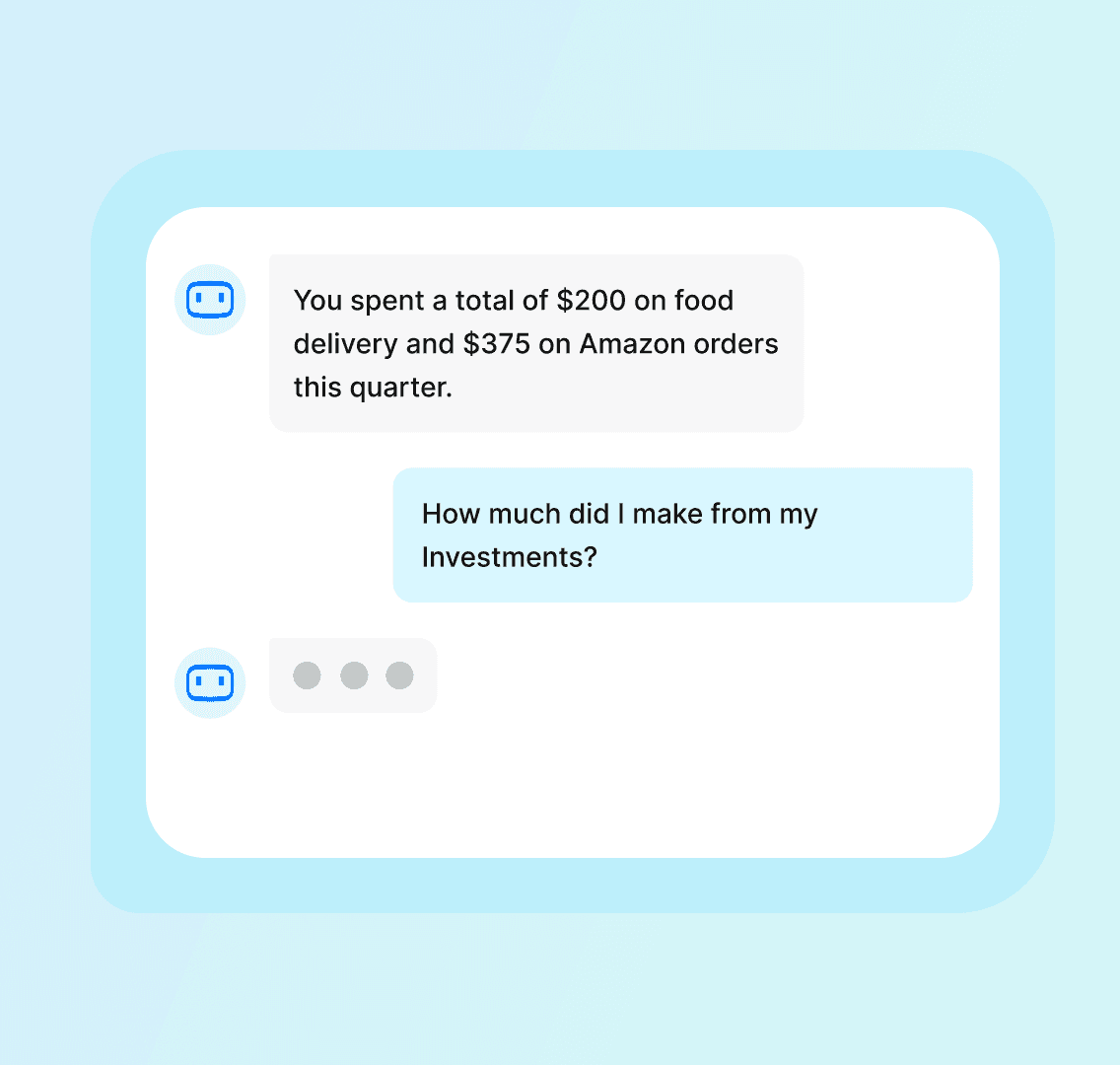

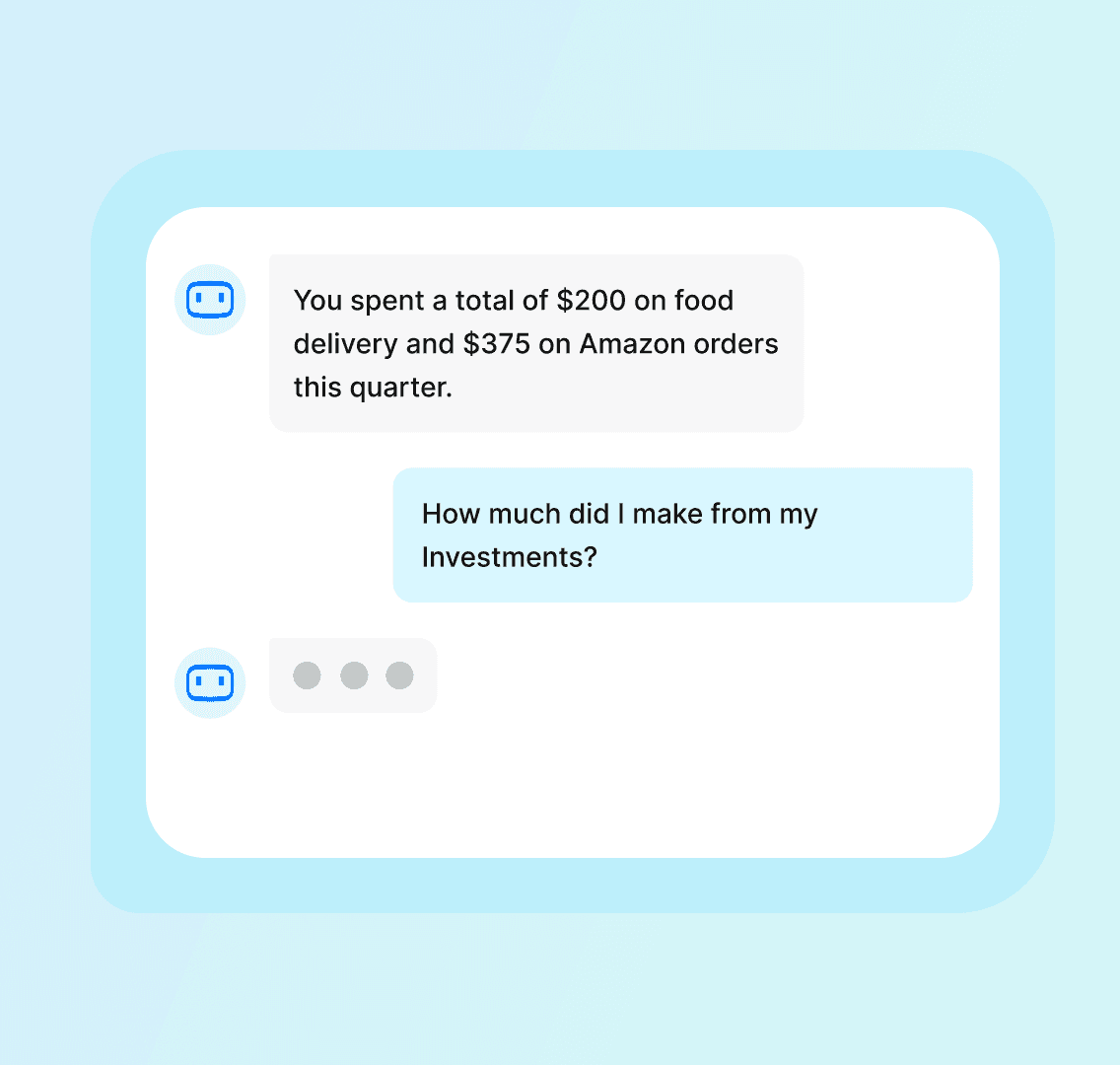

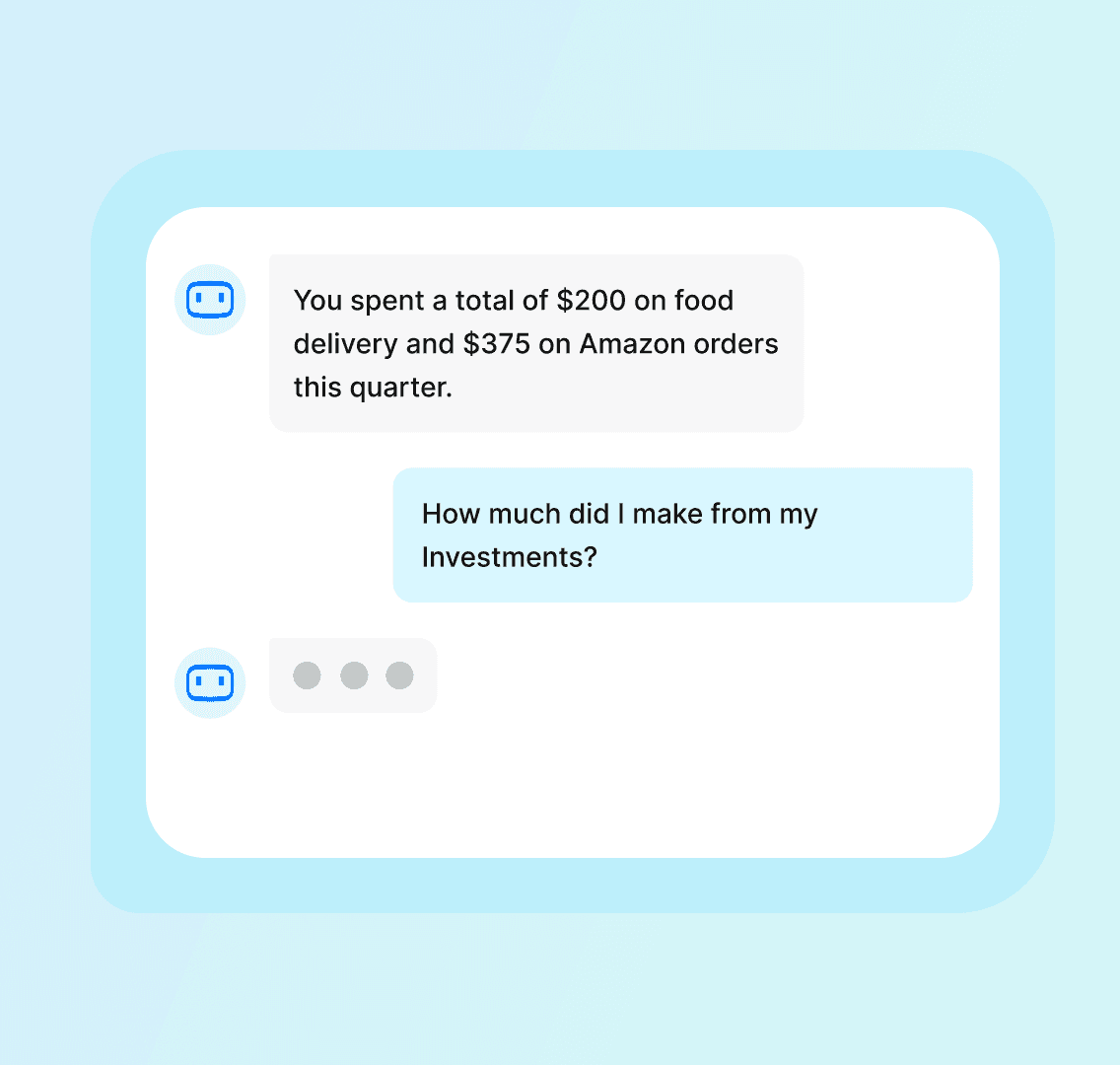

Ask financial queries with ease

Ask our financial chatbot common questions like balance inquiries, last quarter's profits, or account receivables to get quick answers - enhancing CX.

Ask financial queries with ease

Ask our financial chatbot common questions like balance inquiries, last quarter's profits, or account receivables to get quick answers - enhancing CX.

Ask financial queries with ease

Ask our financial chatbot common questions like balance inquiries, last quarter's profits, or account receivables to get quick answers - enhancing CX.

What success looks like with WotNot

1960%

in ROI

"I love how helpful their sales teams were throughout the process. The sales team understood our challenge and proposed a custom-fit solution to us."

Steph Bentley

Senior Communications Manager

175K

feedbacks collected on WhatsApp

"Thanks to WotNot.io, we effortlessly automated feedback collection from over 100k patients via Whatsapp chatbots. Their seamless integration made the process smooth, enhancing patient engagement significantly."

Khaled Ahmed

IT Manager

60K

leads generated every month

"Reflecting back to when we started, we have received over 300K+ leads from all our websites, is an outstanding achievement. We've never seen an ROI of this level in any other martech platform."

Cheytan Kumbhar

Group CEO

What success looks like with WotNot

1960%

in ROI

"I love how helpful their sales teams were throughout the process. The sales team understood our challenge and proposed a custom-fit solution to us."

Steph Bentley

Senior Communications Manager

175K

feedbacks collected on WhatsApp

"Thanks to WotNot.io, we effortlessly automated feedback collection from over 100k patients via Whatsapp chatbots. Their seamless integration made the process smooth, enhancing patient engagement significantly."

Khaled Ahmed

IT Manager

60K

leads generated every month

"Reflecting back to when we started, we have received over 300K+ leads from all our websites, is an outstanding achievement. We've never seen an ROI of this level in any other martech platform."

Cheytan Kumbhar

Group CEO

What success looks like with WotNot

1960%

in ROI

"I love how helpful their sales teams were throughout the process. The sales team understood our challenge and proposed a custom-fit solution to us."

Steph Bentley

Senior Communications Manager

175K

feedbacks collected on WhatsApp

"Thanks to WotNot.io, we effortlessly automated feedback collection from over 100k patients via Whatsapp chatbots. Their seamless integration made the process smooth, enhancing patient engagement significantly."

Khaled Ahmed

IT Manager

60K

leads generated every month

"Reflecting back to when we started, we have received over 300K+ leads from all our websites, is an outstanding achievement. We've never seen an ROI of this level in any other martech platform."

Cheytan Kumbhar

Group CEO

Boost your sales conversion rates

Understand visitors' needs by asking qualifying questions to generate sales-qualified leads, boosting your topline.

Boost your sales conversion rates

Understand visitors' needs by asking qualifying questions to generate sales-qualified leads, boosting your topline.

Boost your sales conversion rates

Understand visitors' needs by asking qualifying questions to generate sales-qualified leads, boosting your topline.

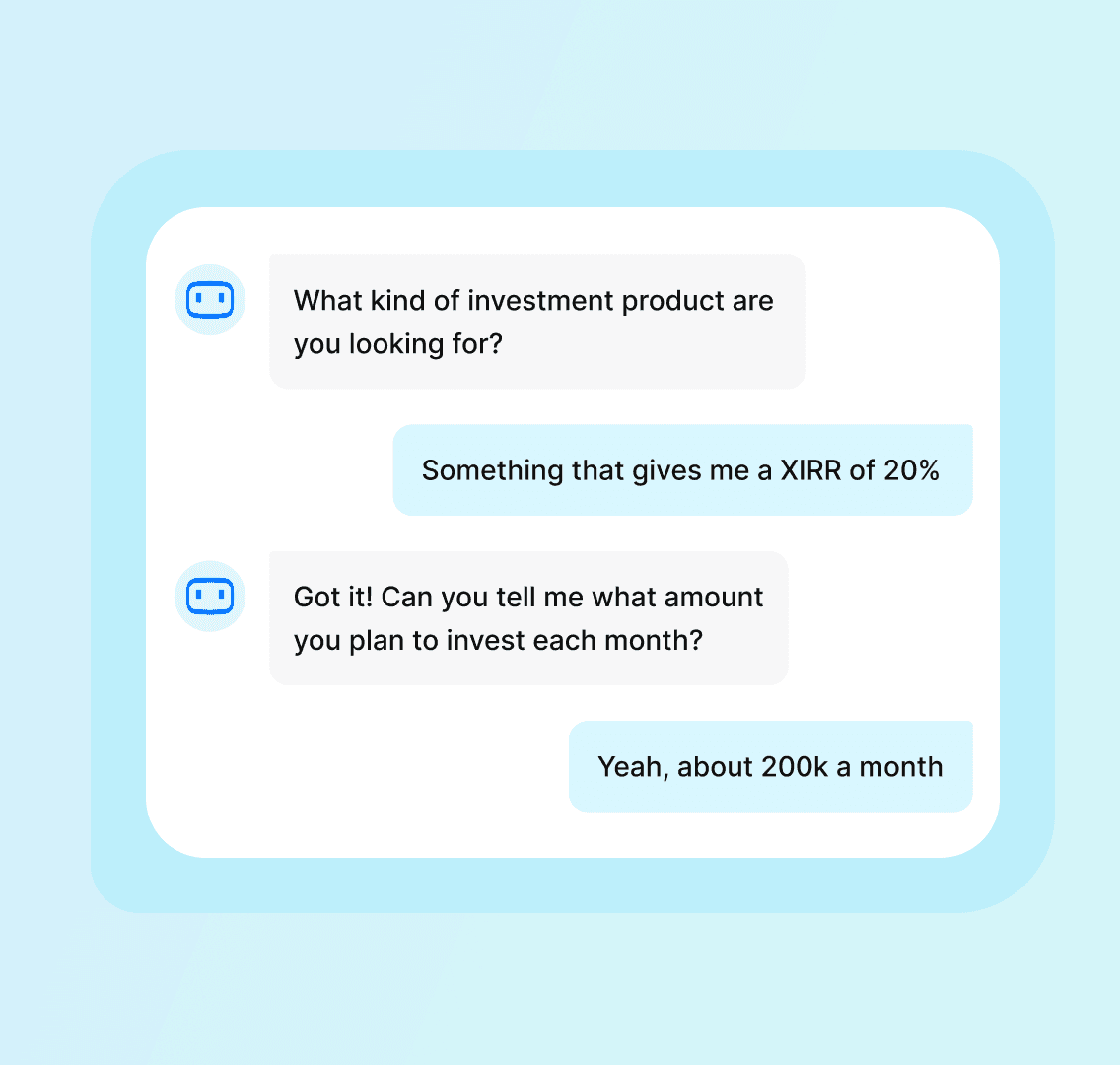

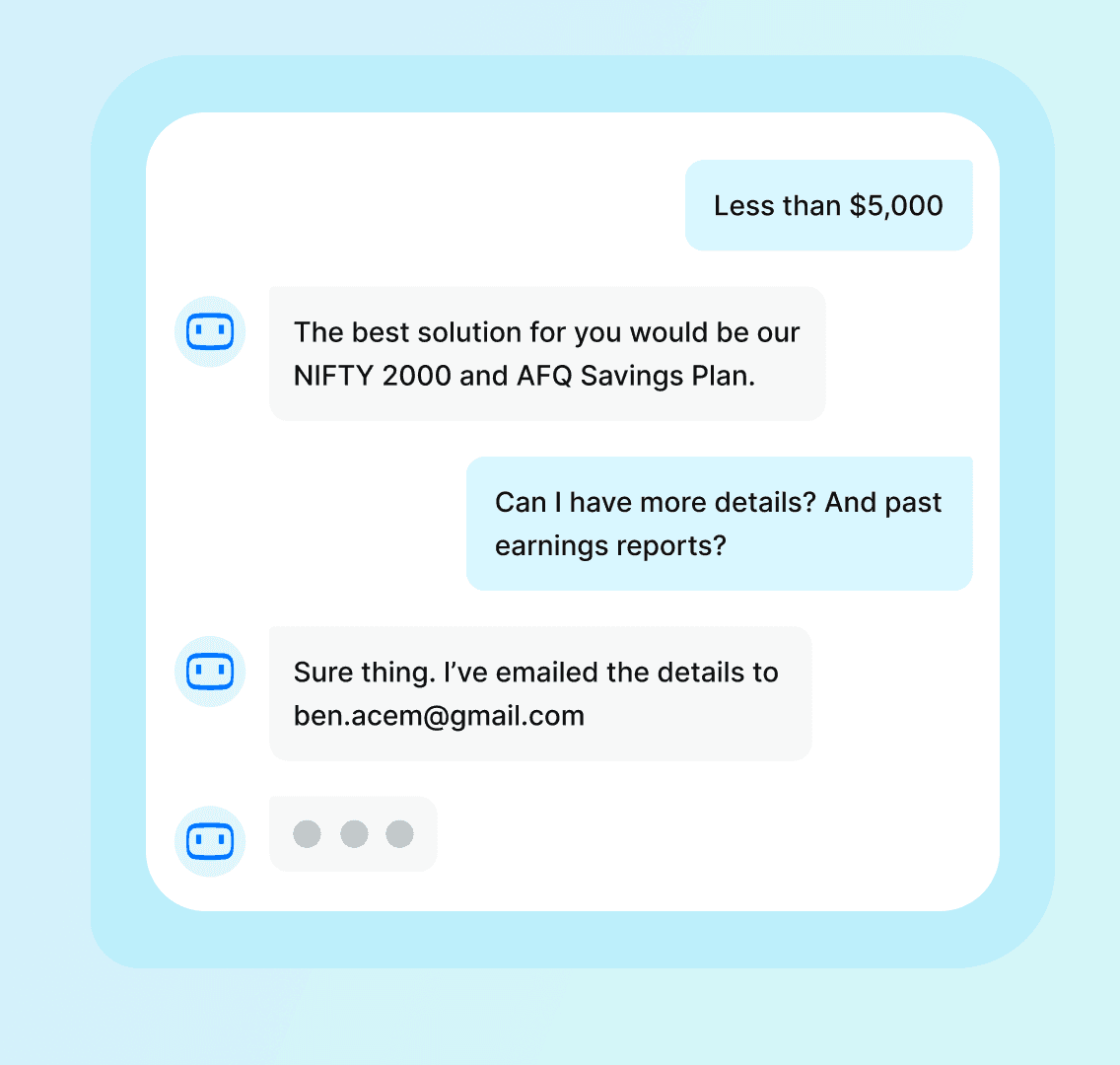

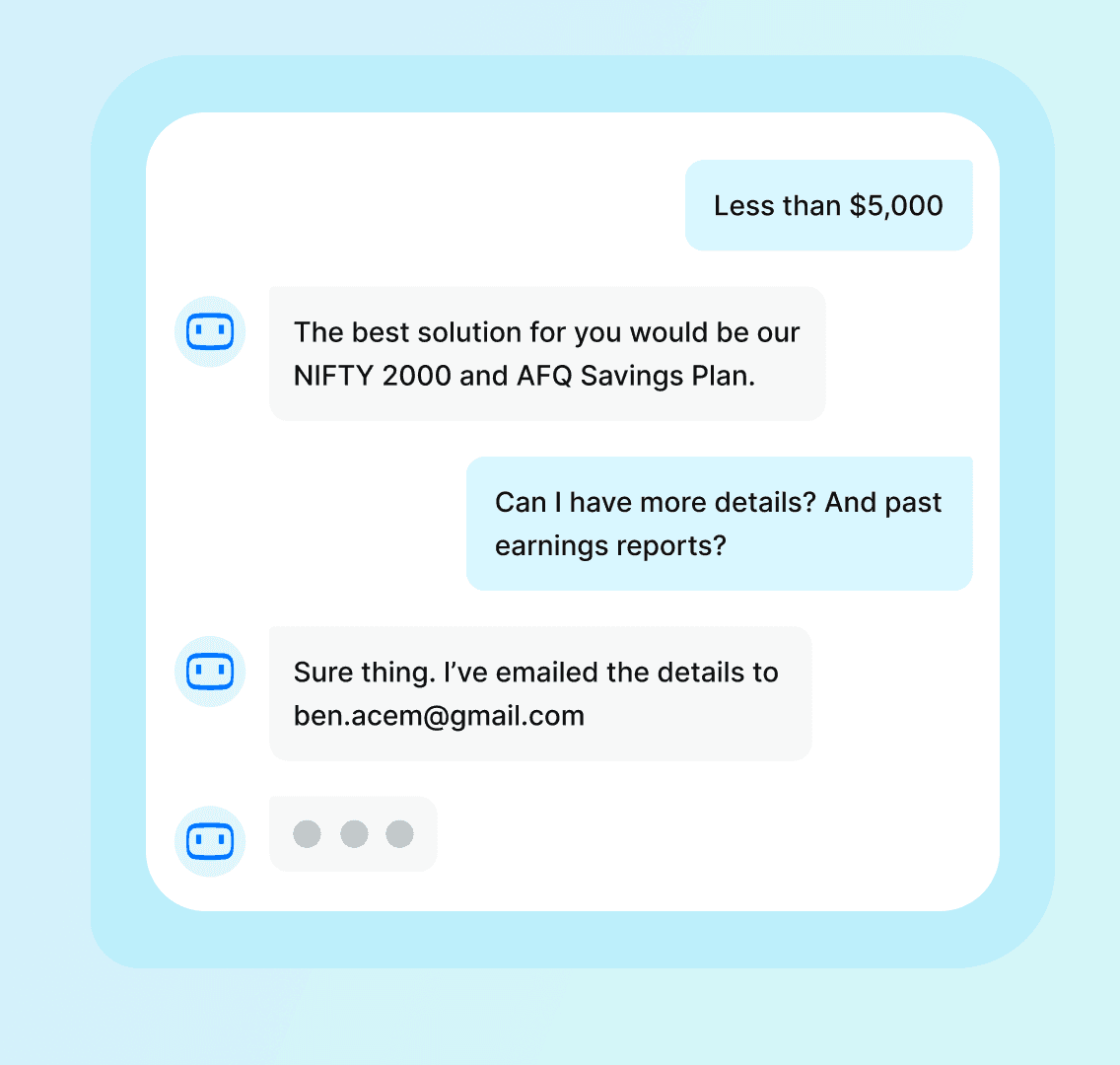

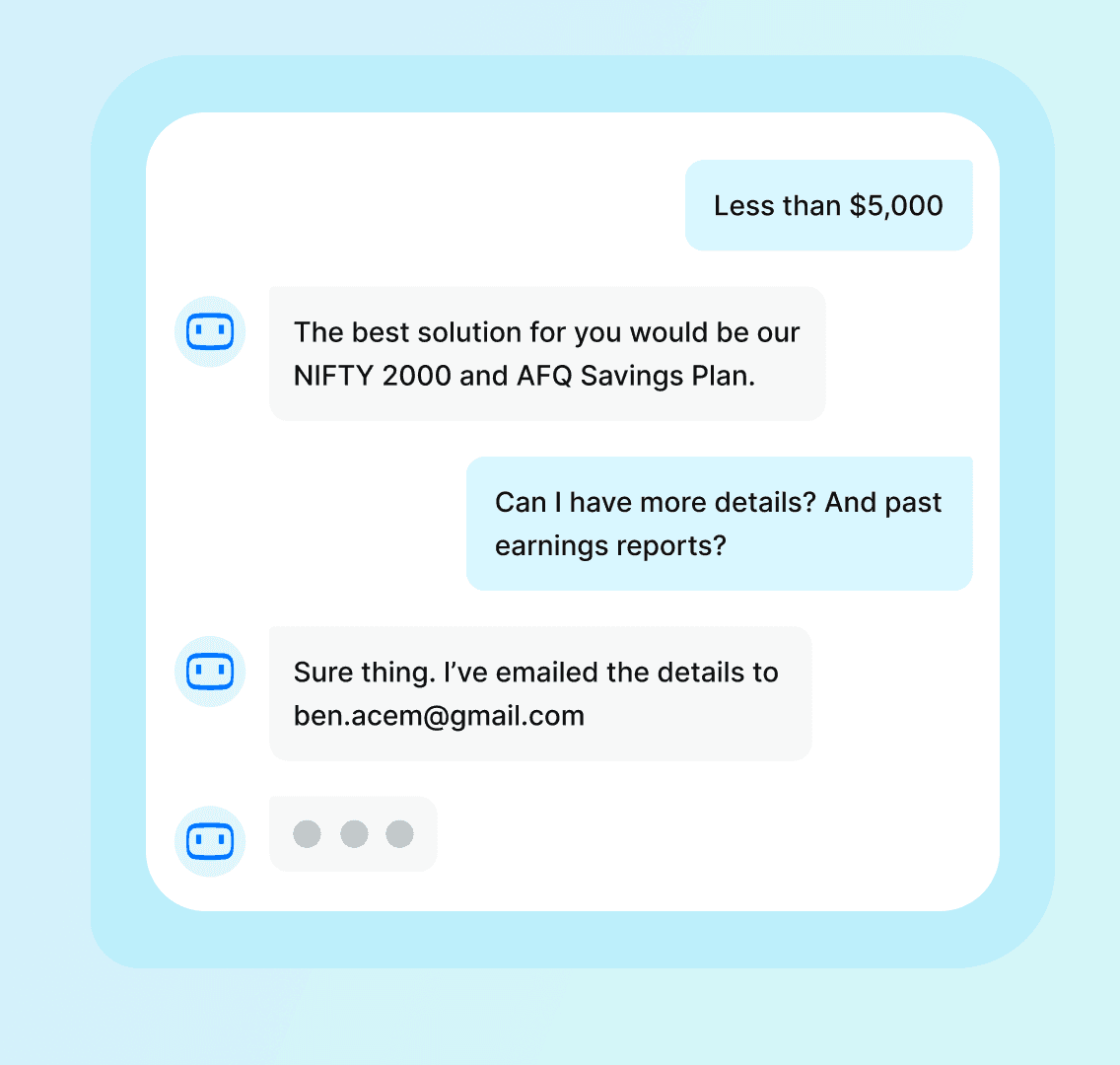

Tailored product recommendations

Engage visitors in conversation to understand their needs, then recommend tailored financial products to foster mutual financial growth.

Tailored product recommendations

Engage visitors in conversation to understand their needs, then recommend tailored financial products to foster mutual financial growth.

Tailored product recommendations

Engage visitors in conversation to understand their needs, then recommend tailored financial products to foster mutual financial growth.

See what we have built

See what we have built

Ready to integrate a financial chatbot to your business?

Book a call with our experts and get consulted.

Ready to integrate a financial chatbot to your business?

Book a call with our experts and get consulted.