Let’s build your chatbot today!

Launch a no-code WotNot agent and reclaim your hours.

*Takes you to quick 2-step signup.

Banking isn't what it used to be. Gone are the days when everything revolved around paper statements and face-to-face meetings. Customers want fast, simple, and hassle-free service that fits into their lives easily.

But here is the issue: many banks and financial institutions are stuck in old habits and slow to adapt to what people really need today.

Traditional customer service? Needs to be faster. Call centers? People are not fond of being on hold. And self-service portals? They are clunky and don’t quite offer the solution customers seek for.

In 2025, chatbots in banking hold the key to delivering fast and accessible service. If a bank isn't using chatbot solutions, it's missing out on a key way to stay competitive.

So, what's going on with banking chatbots? This blog is here to lay it all out.

What are Banking Chatbots?

Banking chatbots are sophisticated computer programs that simulate human-like conversations with customers and are now a core feature of many digital banking solutions.

These chatbots use natural language processing (NLP) and artificial intelligence (AI) to understand and respond to customer queries and interactions in a natural and intuitive manner. By providing personalized customer service, banking chatbots help bridge the gap between technology and human touch, making banking more accessible and efficient.

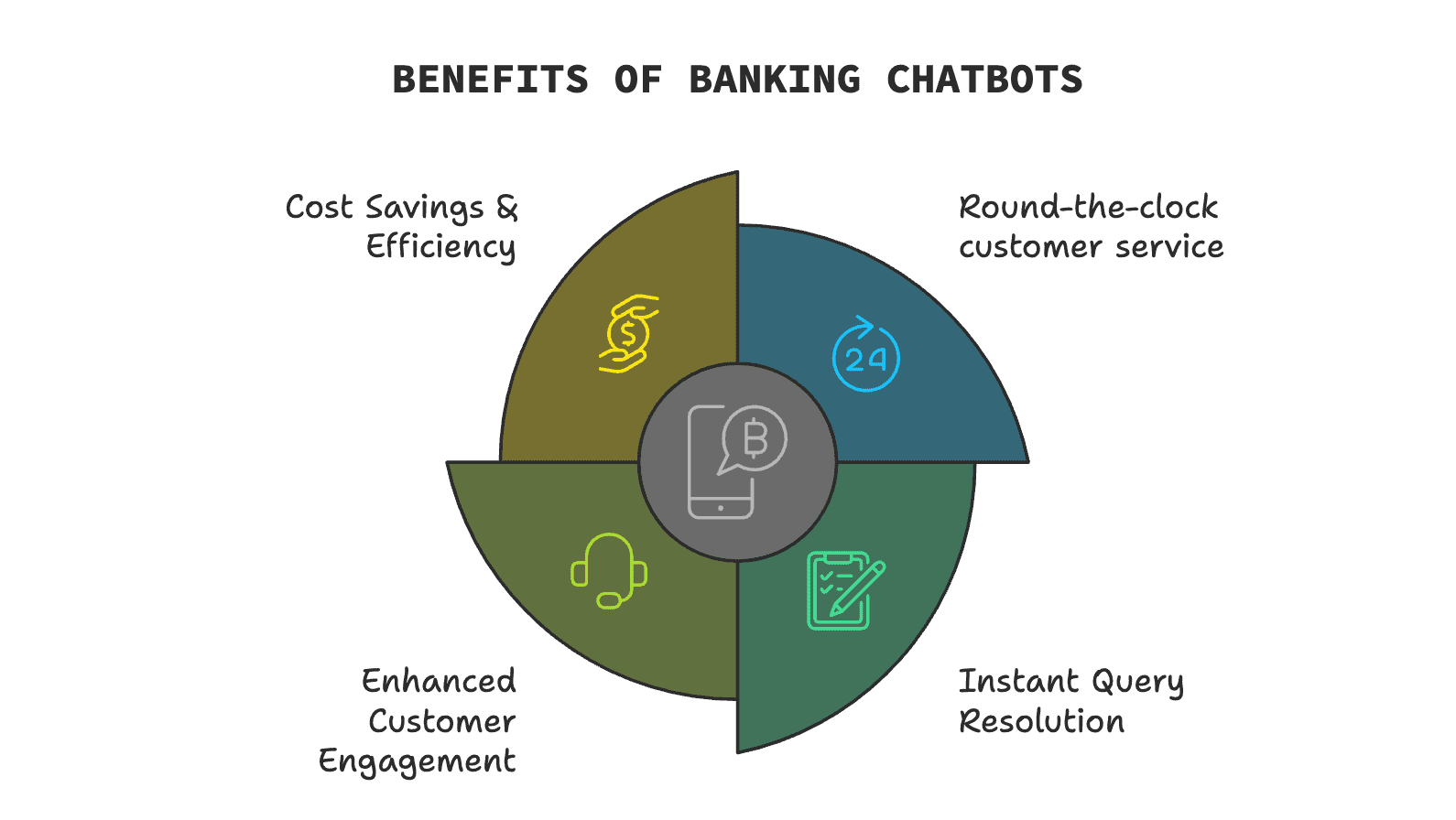

What are the Benefits of Chatbots in Banking?

Banking has always been about meeting customers where they are. Now, it’s happening digitally. Chatbots make this possible by letting banks be available for their customers anytime.

As AI chatbots handles routine tasks, banks can serve clients better and build relationships. In banking services, chatbots enhance customer experience by automating customer interactions and providing real-time assistance.

Here’s a closer look at why chatbots for banks have become essential in the industry:

1. Round-The-Clock Customer Service

In a world that never stops, chatbots ensure banks don’t either. Customers can get help, ask questions, and even complete transactions round the clock. Bank of America’s Erica chatbot gives users their account details, budgeting advice, and basic transactions 24/7. The non-stop service ensures customer satisfaction and strengthens their trust in the bank.

2. Cost Savings and efficiency

For every repetitive query chatbots handle, a bank can save its resources. This is a big deal, especially when we are talking about thousands of inquiries that banks receive each day. Chatbots help banks cut operational costs without compromising service quality. Efficiency isn’t a perk, it’s an advantage.

3. Enhanced customer engagement

Chatbots provide instant engagement, turning passive website visits into meaningful interactions. HDFC Bank’s EVA chatbot interacts with visitors by offering loan details and solving product questions. It helps turn website traffic into active customer relationships.

4. Omni-channel presence

Banking chatbots enhance customer experience by offering omni-channel support across platforms like Voice, Text, iMessage, and WhatsApp. Adapting to customer behavior, they ensure seamless interactions on preferred channels, boosting convenience and strengthening customer relationships.

5. Instant query resolution

Customers don’t want to wait on hold; they want immediate answers. And speed is the name of the game. Banking chatbots resolve simple queries on the spot, with no wait and no hassle. Customers leave happy, and banks maintain high service standards. It’s an instant win for both sides.

That is how chatbots are changing the banking landscape. They provide instant solutions, meeting customer demands and maintaining high-quality support.

But quick answers are just the start. Chatbots are evolving. They can handle a variety of tasks, changing how customers interact with their banks. Let’s dive into the core applications that demonstrate the real power of chatbots in banking.

Let’s build your chatbot today!

Launch a no-code WotNot agent and reclaim your hours.

Let’s build your chatbot today!

Launch a no-code WotNot agent and reclaim your hours.

Let’s build your chatbot today!

Launch a no-code WotNot agent and reclaim your hours.

How Are Chatbots Used in Banking?

Chatbots are transforming banking and financial institutions through a variety of applications, making it easier for customers to engage with their bank and for banks to optimize their processes.

Here’s a breakdown of some key use cases:

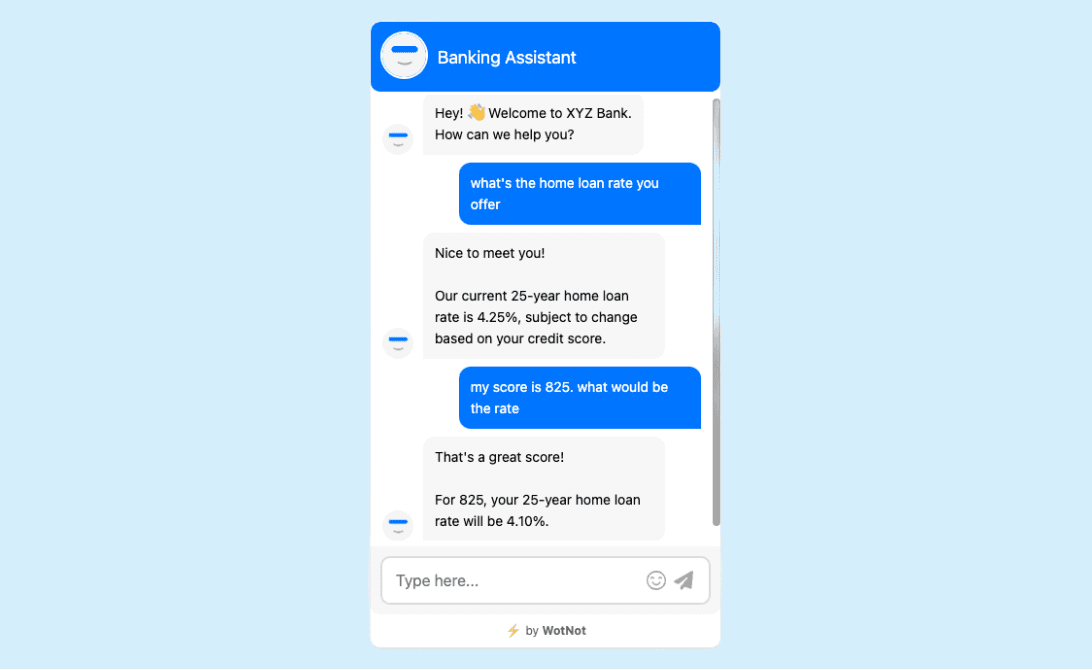

1. Improved Customer Experience (CX) on Websites

Bank websites can be challenging to navigate, often leaving customers frustrated when searching for quick answers or specific product details. Complex menus and dense information make this process time-consuming, especially for financial institutions.

By leveraging LLMs, banking chatbots train on the bank’s website and internal documents, enabling them to answer any question efficiently. Acting like a personalized ChatGPT for the bank, they handle customer service queries in real time, addressing products, services, and policies. This enhances the user experience and boosts customer satisfaction.

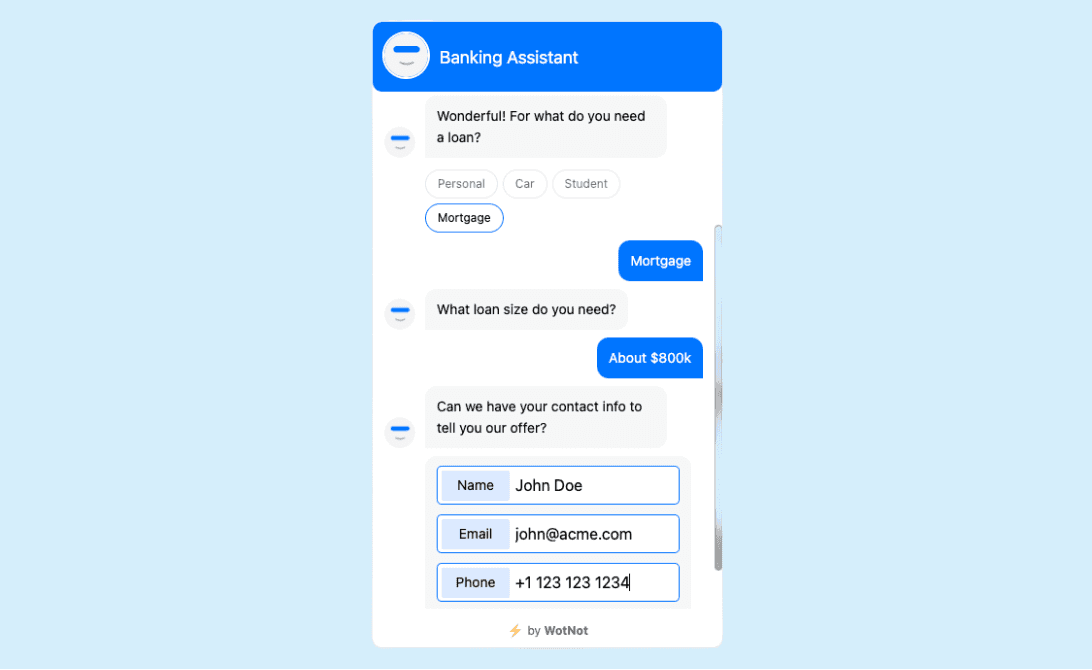

2. Generating New Inquiries / Leads

Every website visitor is a potential client, and banking chatbots capture this interest from the moment they arrive. Chatbots identify visitors who want to learn more, their area of interest, and gather contact details for follow-up. Chatbots can also analyze a customer's spending habits to suggest tailored financial products.

The result? More qualified leads, higher engagement, and increased potential for conversions.

This personalized approach also allows chatbots to ask about visitor preferences. That helps in generating more qualified leads and driving engagement. The Royal Bank of Canada’s NOMI chatbot goes a step further with this. It analyzes individual spending habits and offers tailored financial insights. This makes interactions more relevant and encourages customers to explore additional services.

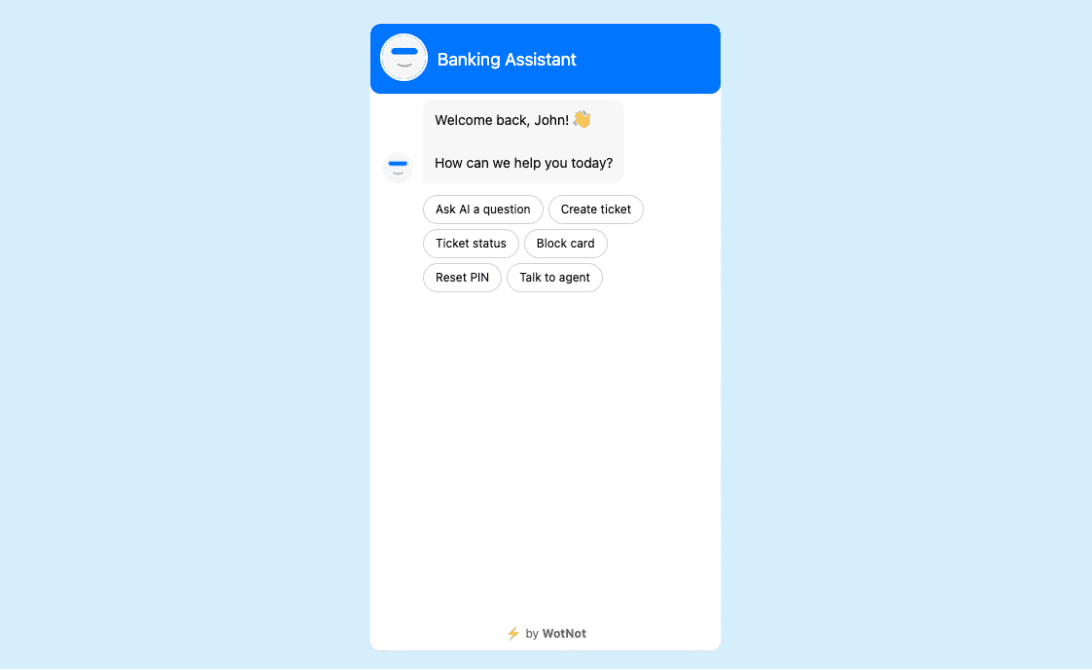

3. Automating Customer Support

Banks can significantly enhance customer experience (CX) by using chatbots to manage Level 1 (L1) and Level 2 (L2) support queries. Most customer inquiries, such as account details, loan information, or card-related issues, are straightforward and can be resolved quickly. Chatbots, trained on the bank’s website data and internal documents, are well-equipped to handle these questions efficiently. This ensures customers get accurate and instant responses without the need to wait for a human agent, improving satisfaction and reducing response times.

In addition to addressing common inquiries, chatbots excel in resolving support queries like fetching account balances, finding branch locations, nearby ATMs, or checking the status of service tickets. By automating these repetitive tasks, banks can provide fast, 24/7 support, enhancing CX.

For more complex queries that require human expertise, chatbots seamlessly transfer the conversation to live agents, ensuring continuity and a personalized touch when needed. This hybrid approach not only optimizes resource allocation but also creates a well-rounded support system for customers.

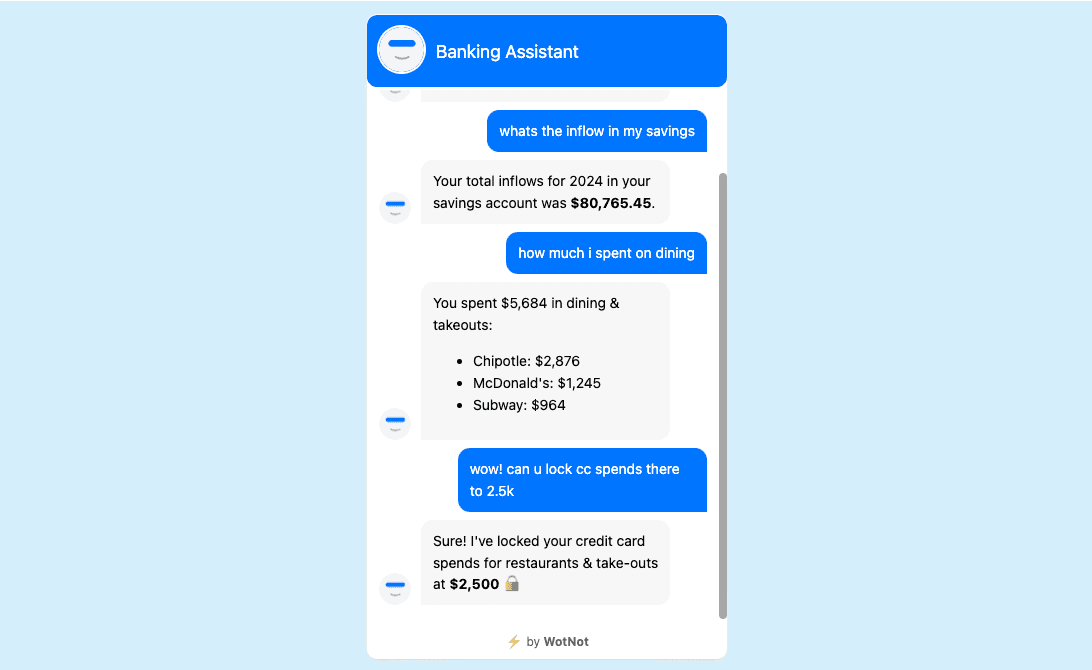

4. Personal Banking Assistant

With the rise of AI agents, the banking industry is revolutionizing customer experiences by integrating virtual banking assistants into their portals. A banking chatbot can handle a variety of banking tasks, allowing customers to give simple instructions like “How much did I spend on restaurants last month?” or “What’s my inflow for 2025 like?” They can even act on customer requests such as transferring $5,000 to a landlord or or guiding ultra-high-net-worth clients through the costs of a living trust. This innovation enables financial institutions to simplify complex processes and provide seamless, task-oriented assistance to their users.

Every customer essentially gains a personalized assistant capable of performing banking tasks efficiently, reducing the need for manual intervention. By addressing customer requests with speed and accuracy, these banking chatbots make managing finances effortless. This not only enhances convenience but also strengthens the relationship between financial institutions and their customers, setting a new standard for personalized service in the banking industry, particularly with the growing adoption of AI for credit union services tailored to meet member-specific needs.

Yet, for all the benefits chatbots in banking offer, the path to adopting them isn’t without challenges. Let us understand them.

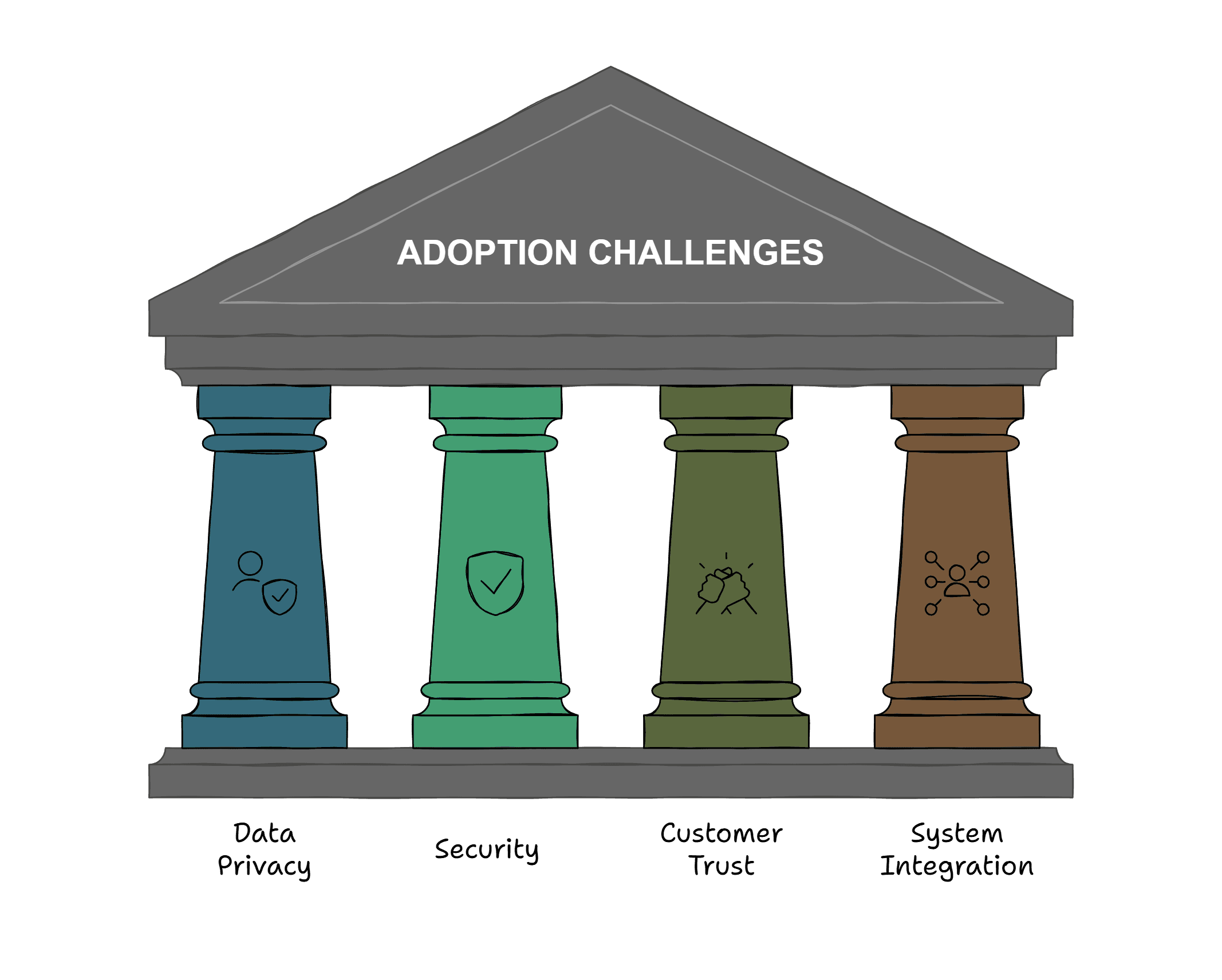

What Are the Adoption Challenges of Chatbots in Banking?

The potential for conversational AI in banking and financial institutions is massive, but making the switch is no walk in the park. Banks need to tackle some serious challenges to get it right.

Here are some challenges in adopting a banking chatbot and how banks are proactively working on tackling them.

1. Data Privacy

Banking is built on trust, and that means handling data with the utmost care. Customers give their information with an expectation of security, and banks have no room for error here. Chatbots must be watertight on privacy—meeting regulations like GDPR is not negotiable.

Each interaction and query handled by chatbots for banks has to protect data as effectively as any other part of the bank’s operation.

Barclays, for example, has strict data privacy protocols across its AI systems. This ensures every conversation remains secure and compliant. It’s not a checkmark on a list; it’s a foundation of customer confidence.

2. Security

In banking, security is everything. Bank authorities must fortify the chatbots handling sensitive information against any cyber threats. We are talking about layers of encryption, multi-factor authentication, SOC 2 Compliance firewalls and real time transaction monitoring to detect and respond to suspicious activity instantly.

Additionally, analytics-driven chatbot systems rely on secure APIs to ensure the safe exchange of customer and banking data across internal platforms and third-party services.

There’s no second chance if an interaction with a banking chatbot gets compromised.

Standard Chartered Bank understands this well. It has equipped its chatbot system with top-tier security protocols, making sure it protects each interaction end to end.

For banks, it is a constant battle against potential threats, but it’s the only way to maintain the trust they have built.

3. Customer Trust and Adoption

Not everyone is ready to trust a bot with their banking needs. Some customers still want that human touch and a sense of security from speaking with a real person. Building customer trust means giving choices and letting people get comfortable with chatbots.

JPMorgan Chase does this by pairing its chatbot with live agents. Thus, customers can choose to interact with AI or switch to a human whenever they prefer. This gives them control and helps them feel secure as they explore this new way of banking.

4. Integration with Core Banking Systems

Banking chatbots don’t work in isolation; they are only as useful as the information they can access. Chatbots enhance operational efficiency and client interactions within the financial sector. To serve customers, a bank or financial institution needs to integrate chatbots fully into the core systems. It must include real-time data, transaction histories, and product databases.

This level of integration doesn’t happen overnight; it’s a careful, often costly banking process. But Wells Fargo has ensured its banking chatbot is not another answering machine. It offers accurate responses and real-time support. This is a real asset for customers and employees alike. For banks dealing with complex legacy systems, regulatory constraints, and high security requirements, working with an artificial intelligence software development company can help ensure chatbot solutions are designed to be secure, scalable, and compatible with core banking environments.

These aren’t just obstacles to overcome. They are essential pieces in building a chatbot that can meet the high demands of modern banking. When banking chatbots get data privacy, robust security, customer choice, and deep integration right it becomes a trusted, valuable tool.

But the landscape is shifting fast. A banking chatbot isn't static. They are evolving as new technology and capabilities emerge.

Let’s look at the chatbot platforms that are shaping the next generation of banking chatbots.

The 5 best banking chatbots in 2025

As more banks adopt these customer service chatbots, choosing the right platform is crucial.

Here, we explore the top five banking chatbots of 2025, highlighting their strengths and limitations to help you find the best fit for your needs in the banking sector.

1. WotNot

WotNot stands out as a cost-effective solution for the banking sector, offering end-to-end chatbot solutions designed to meet customer expectations and needs. With top-notch security through on-premise installations and deep integration capabilities, WotNot ensures seamless connectivity with existing banking systems, making it an ideal choice for streamlining customer queries. Its no-code, easy-to-use platform further enhances customer satisfaction by empowering banks to deliver intuitive and efficient chatbot experiences.

However, WotNot lacks voice capabilities out of the box, which may be a limitation for banks focusing on voice-based customer service.

Start building, not just reading

Build AI chatbots and agents with WotNot and see how easily they work in real conversations.

Start building, not just reading

Build AI chatbots and agents with WotNot and see how easily they work in real conversations.

Start building, not just reading

Build AI chatbots and agents with WotNot and see how easily they work in real conversations.

2. Kasisto

A veteran in the banking industry, Kasisto boasts proven expertise in serving the financial sector. Its multi-lingual capabilities allow banks to cater to a global customer base, making it a strong contender for enhancing customer service.

On the downside, Kasisto’s platform is criticized for poor UX, which may hinder usability for banking chatbots administrators.

3. Glia

Glia offers a comprehensive contact center solution, making it a one-stop platform for addressing customer queries in the banking sector. Its robust feature set integrates artificial intelligence with live customer service agents, ensuring seamless service delivery.

However, Glia’s pricing is steep, and the setup process can be technically challenging for non-experts.

4. Kore.ai

With its extensive industry experience and custom-built LLM and artificial intelligence models, Kore.ai is tailored for ultra-large banks. This platform excels in managing complex customer interactions in the banking industry.

However, its focus on catering exclusively to large-scale institutions may alienate mid-sized banks seeking advanced banking chatbots.

5. Ada.cx

Ada.cx is renowned for its easy implementation, thanks to its low-code interface. This platform empowers banks to quickly deploy AI-driven solutions for managing customer queries.

While Ada.cx simplifies implementation, its expensive pricing may deter cost-conscious organizations in the banking sector.

What’s Next for Chatbots in Banking?

The future of chatbots for banking isn’t about automation anymore. It is also about creating a new type of experience, one that is closer, more personal, and almost intuitive. Chatbots have branched into territory that changes how people interact with their banks.

These chatbots won’t just answer questions. They will predict needs, guide decisions, and make banking feel like less of a chore.

Two trends are driving this transformation: voice-based assistance and predictive banking. Here is a closer look at both the trends and how it is changing the automation landscape.

1. Voice-Based Assistants

As banks dive into voice technology, they are exploring ways to let customers interact without typing a single word. We are seeing chatbots evolve into voice-activated assistants (utilizing Natural Language Processing), where all a customer has to do is speak, and the chatbot does the work.

This technology is already in use with services like Capital One’s Eno. It lets customers check balances, review recent transactions, or set up reminders using voice commands. This is not just a convenience for the sake of convenience. It creates a hands-free experience that fits into busy lives, letting people manage their banking while on the go.

2. Predictive Banking

Then there is predictive banking—the kind of service that doesn’t wait for a customer to ask a question. Instead, it proactively serves up insights based on the customer’s past behavior, anticipating what they might need or want to know.

Chatbots in banking can now tell customers their balance and warn them that they are nearing their budget for the month. It even suggests ways to save. Royal Bank of Canada’s NOMI chatbot takes a close look at spending patterns and flags things customers might miss. NOMI can predict overdrafts before they happen, giving customers a heads-up to avoid fees and make adjustments.

That’s how voice-based assistant and predictive banking are transforming the regular banking experience for banks and customers alike. This changes how people view their banks - not just as places to stash cash, but as partners in their financial journey.

Banks, by adding this layer of proactive service, can connect with customers in a way that feels valuable and relevant.

Voice-based assistants and predictive chatbots are just the beginning. As banks continue to invest in these technologies, the line between chatbots and personal advisors will blur even more.

In Summary: A Bank Ready for Tomorrow

Chatbots aren’t just a passing trend in banking; they are a glimpse into the future. By handling repetitive tasks and enhancing customer interactions, chatbots let banks focus on serving their clients in the best way possible.

Soon, customers will have digital assistants that don’t just respond—they anticipate, understand, and support. This is where the future of chatbots is heading, and it’s a future that’s all about making banking feel less like a transaction and more like a service built around real human needs.

For banks ready to embrace this future, WotNot offers a comprehensive solution. As a end-to-end solution provider we provide banks with the tools and professional services needed to build, deploy, and optimize banking chatbots.

Get in touch with our team today!

This article was originally published in May 2020. The most recent update was in July 2025.

ABOUT AUTHOR

Hardik Makadia

Co-founder & CEO, WotNot

Hardik leads the company with a focus on sales, innovation, and customer-centric solutions. Passionate about problem-solving, he drives business growth by delivering impactful and scalable solutions for clients.

Start building your chatbots today!

Curious to know how WotNot can help you? Let’s talk.

Start building your chatbots today!

Curious to know how WotNot can help you? Let’s talk.

Start building your chatbots today!

Curious to know how WotNot can help you? Let’s talk.